Understand the Risk. Appreciate the Return

Every investment carries risk, but with rigorous due diligence, transparent reporting, and decades of experience, we work to manage those risks and maximise your returns.

At Karlyn Developments, honesty and clarity come first.

We believe investors deserve to understand both the opportunities and the risks involved.

That’s why we don’t hide behind small print or unrealistic promises. Instead, we combine over 40 years of industry experience with a disciplined, transparent approach designed to protect your capital and deliver consistent results.

Property Development Naturally Balances Risk and Reward

Every form of investment - whether in property, stocks, or savings - involves risk. The difference lies in how that risk is managed.

Property is unique because it’s built on tangible assets. Every project we undertake is backed by real value and carried out under our direct management and oversight.

Our goal isn’t to eliminate risk, it’s to control it. We assess every opportunity for profitability, location strength, and build feasibility before a single pound is invested.

Our Five-Step Risk Management Framework

We take a structured, professional approach to safeguarding every investment.

Due Diligence:

Every property is carefully vetted, from title checks to local market analysis, ensuring it meets strict profitability and compliance standards.Diversification:

We spread investments across multiple property types and locations to minimise exposure to any single factor.

Fixed Build Budgets:

Our trusted contractor network and supplier agreements keep costs predictable and projects efficient.

Regular Monitoring:

Weekly photo updates, budget reviews, and progress reports keep every investor informed and every project accountable.

Legal Protection

Every investment is formalised with a clear legal agreement tailored for private property investment. Investors are encouraged to seek independent advice before signing.

Property Development Naturally Balances Risk and Reward

We’re proud of the returns our investors have achieved: an average of around 26% across previous projects.

But we’ll never overpromise.

Our focus is on delivering consistent, achievable results, guided by detailed planning and hands-on management.

You’ll always know expected timelines, projected profit shares, and potential risks before committing, so you can invest with clarity and confidence.

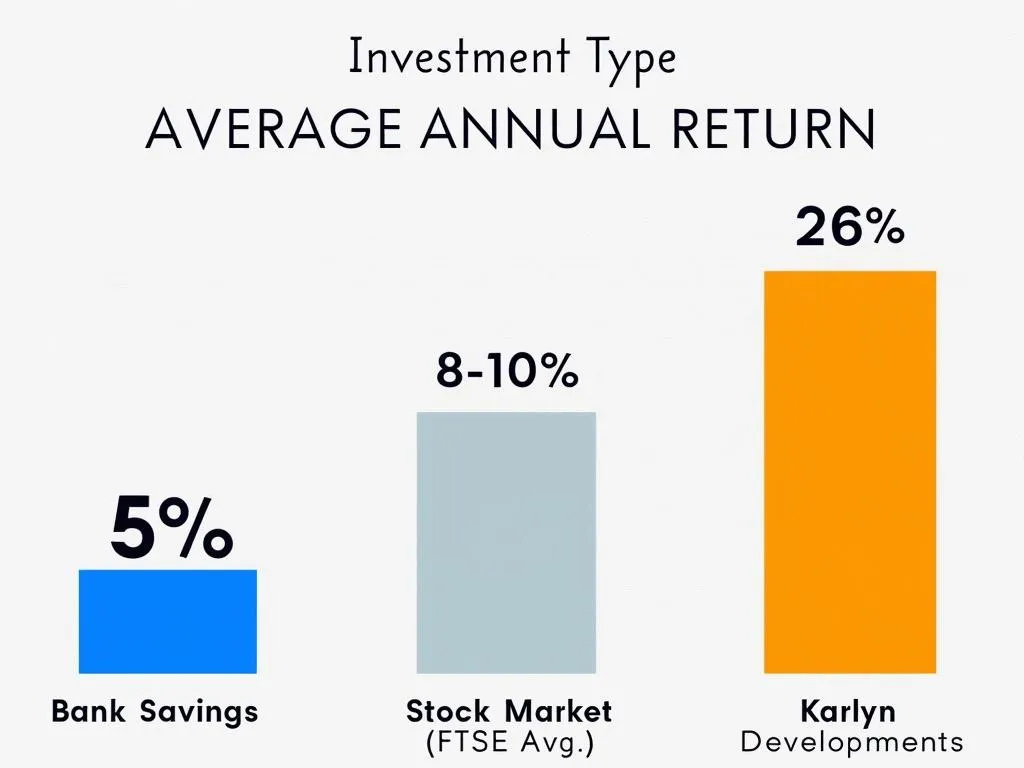

Property investments can outperform traditional savings — when managed with the right expertise. While typical UK savings accounts currently offer around 5% interest and the stock market averages around 8–10%, Karlyn Developments’ investors have achieved average returns of approximately 26%.

Every project is different, and results will vary, but our proven approach — built on experience, due diligence, and transparency — gives investors the best opportunity to enjoy strong, sustainable returns.

You’re Never Left in the Dark

Transparency is built into everything we do. From the moment you invest, you’ll have access to:

Weekly progress reports and financial summaries.

Photo updates showing on-site progress.

Regular communication from our investor relations team.

We believe confidence comes from visibility, and we make sure you always know how your investment is performing.

A Note on Risk Disclosure

As with any investment, capital is at risk. Property values can fluctuate, and project timelines may occasionally extend due to factors beyond our control.

Investments with Karlyn Developments are not covered by the Financial Services Compensation Scheme (FSCS). We strongly recommend that investors seek independent financial advice before committing funds.

Our commitment is to full transparency, so you can make informed decisions based on clear, accurate information.

Clarity, Confidence, and Control — That’s Our Promise

Invest with a partner who values transparency as much as performance.

Want to work with us?

Copyright 2026 All Rights Reserved.